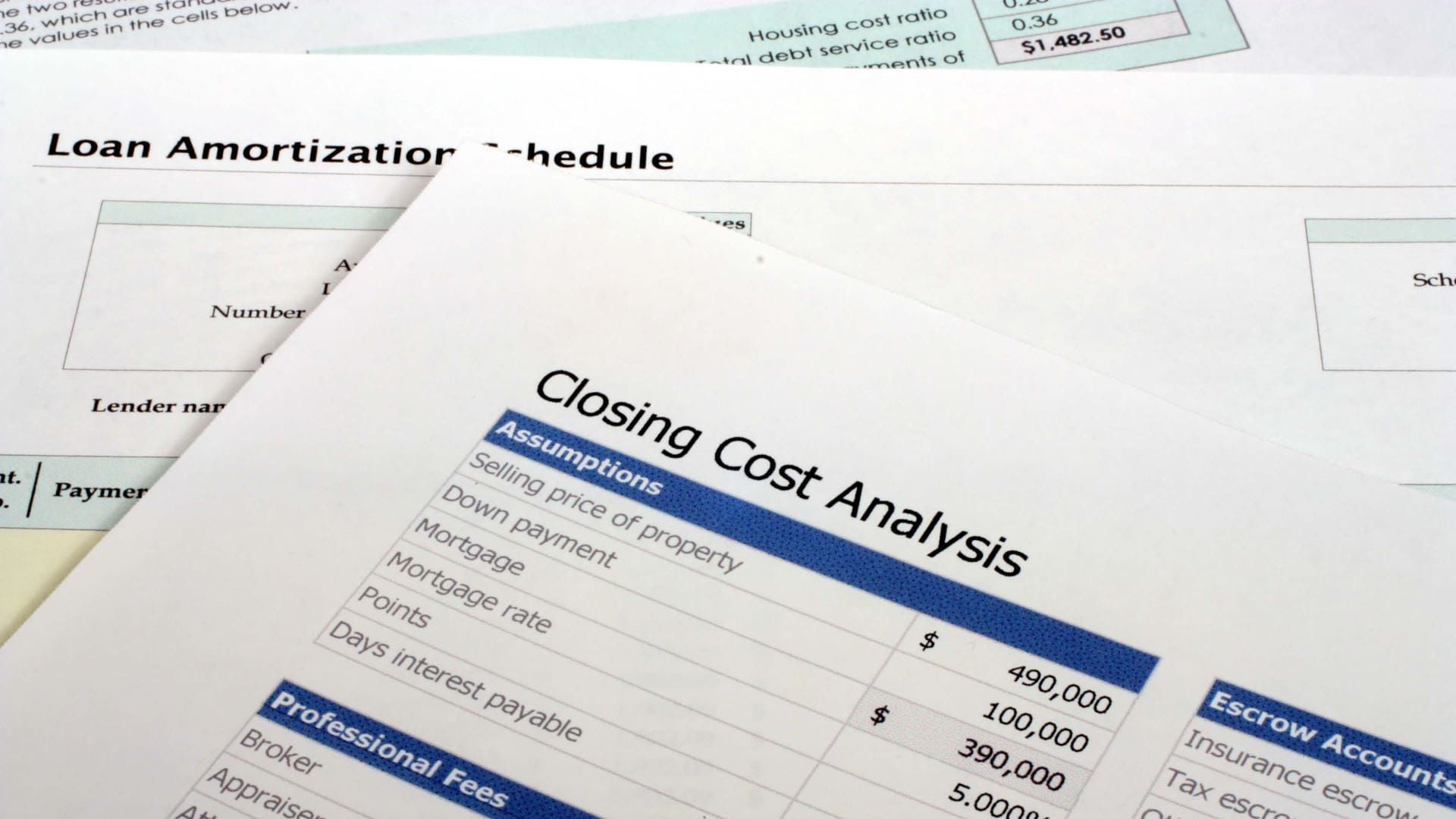

Buying a home is exciting, but it can seem overwhelming with the amount of different fees and expenses beyond just the down payment. Closing costs are a catch-all term for just about all expenses that go into buying a home. Understanding these costs and how they affect your budget can put you in a better position preparing for home buying and avoid surprises and stress on closing day.

What Are Closing Costs?

Closing costs are fees and expenses paid at the finalization of a real estate transaction. They cover various services and admin tasks necessary to transfer ownership from the seller to the buyer. These costs typically range from 2% to 5% of the loan amount and can include:

- Origination Fees: Charged by the lender for processing the loan application. This fee compensates the lender for evaluating and preparing your mortgage loan.

- Appraisal Fees: Paid to a professional appraiser to determine the market value of the property. This ensures the lender that the property is worth the amount you’re borrowing.

- Inspection Fees: Cover the cost of home inspections to identify any potential issues or repairs needed before finalizing the sale.

- Title Search and Title Insurance: A title search verifies the property’s legal ownership and makes sure there are no outstanding claims against it. This protects both you the buyer and the lender from any future claims on the property’s title.

- Attorney Fees: In some states, hiring a real estate attorney to review contracts and oversee the transaction is required. This fee varies depending on the complexity of the deal and local practices.

- Recording Fees: Charged by the county to officially record the new ownership of the property so the transaction is documented and recognized by local government authorities.

- Escrow Fees: Paid to an escrow company or agent who manages the funds and paperwork involved in the closing process.

- Property Taxes and Homeowner’s Insurance: Depending on the time of year, you may need to prepay property taxes and homeowner’s insurance premiums at closing. If the home you buy hasn’t been evaluated in a while, expect the property taxes to bump up in the first few years of ownership. Depending on your local market this may be reevaluated regularly.

How to Prepare for Closing Costs

- Get a Good Faith Estimate (GFE): Lenders are required to provide a Good Faith Estimate of closing costs within three days of receiving your loan application. Review this document carefully to understand the estimated costs.

- Request a Loan Estimate: This form provides a detailed breakdown of the costs associated with your mortgage, including both upfront and recurring costs. Compare it to your GFE to ensure accuracy, ask about any discrepancies early.

- Budget Accordingly: Set aside funds for closing costs in addition to your down payment. Having a cushion can help you blunt unexpected expenses.

- Negotiate with the Seller: In some cases, you may be able to negotiate with the seller to cover part or all of your closing costs. This can be particularly useful in a buyer’s market. If you see their home has been on the market for a long while, you may be a good position to negotiate.

- Review the Closing Disclosure: This document provides the final details of your loan and closing costs. Review it carefully before closing day to ensure all fees match what you were initially quoted.

Other Fees to Have In Mind

- Earnest Money (EMD): Think of this as a Good Faith Deposit to show the seller you’re serious about purchasing, this can be 1-3% of the sale price, but the exact amount largely depends on your local market. A key thing to remember about the EMD is that it’s not a separate fee in addition to the above. These funds are held in an escrow account until the deal is complete and assuming all goes well with the transaction, will be applied to cover some of the closing costs. If, for whatever reason, the deal falls through the buyer usually gets this money refunded, however some sellers may include a non-refundable EMD.

- HOA Fees: These fees are determined by the community and are a sometimes a big cost to consider depending on the home you’re considering. These may come directly from you, but are also sometimes included into your escrow account

- Moving Costs: Don’t forget the cost of the actual move! Depending on how much furniture and other things you own, this could range from hundreds, to thousands of dollars. Plan ahead and get quotes from several companies to cost-compare, and to have as backup in case the first choice falls through.

The information above is a great starting point, but to take action, it’s important to consult with a financial advisor to make the best decision for your exact situation. And remember, when embarking on your homeownership journey, it’s wise to leave yourself a bit of wiggle room for the unexpected! By understanding these expenses and budgeting accordingly, you can navigate the closing process with confidence and avoid any last-minute surprises. Remember, a smooth closing is just the beginning of your new home adventure!

Did you know that nearly 50% of the home sales last year were done outside of the MLS? This means that most buyers are missing out on half of the homes that are actually available. If you want exclusive access to thousands of off-market properties, Call or Text us at 571-470-5447 to get hot new listings BEFORE they can be found on platforms online. Our clients love our off-market Priority Access List! We are proactive and find homes that no other buyers have access to! Priority access means you’re there first, before other buyers, for a quick, easy transaction!

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.